The smart Trick of Medicare Advantage Agent That Nobody is Talking About

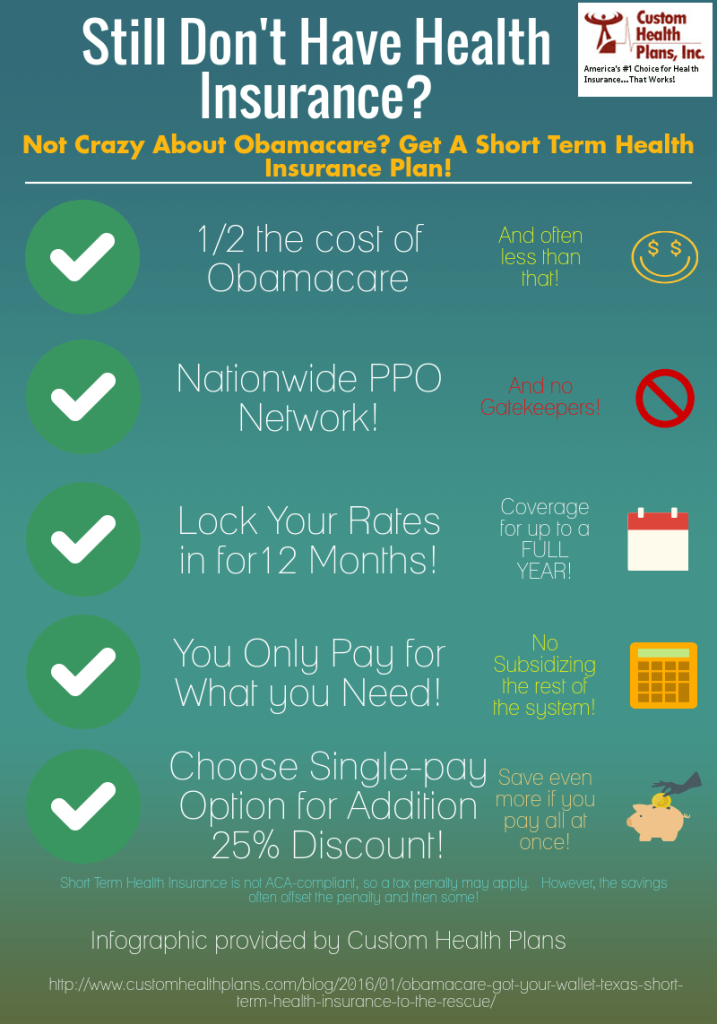

Having health and wellness insurance coverage has lots of advantages. Even if you are in good health, you never recognize when you could have a mishap or get sick.

Average prices for giving birth depend on $8,800, and well over $10,000 for C-section distribution. 1,2 The complete expense of a hip replacement can run a monstrous $32,000. These instances sound terrifying, yet the bright side is that, with the right strategy, you can secure yourself from many of these and various other kinds of medical expenses.

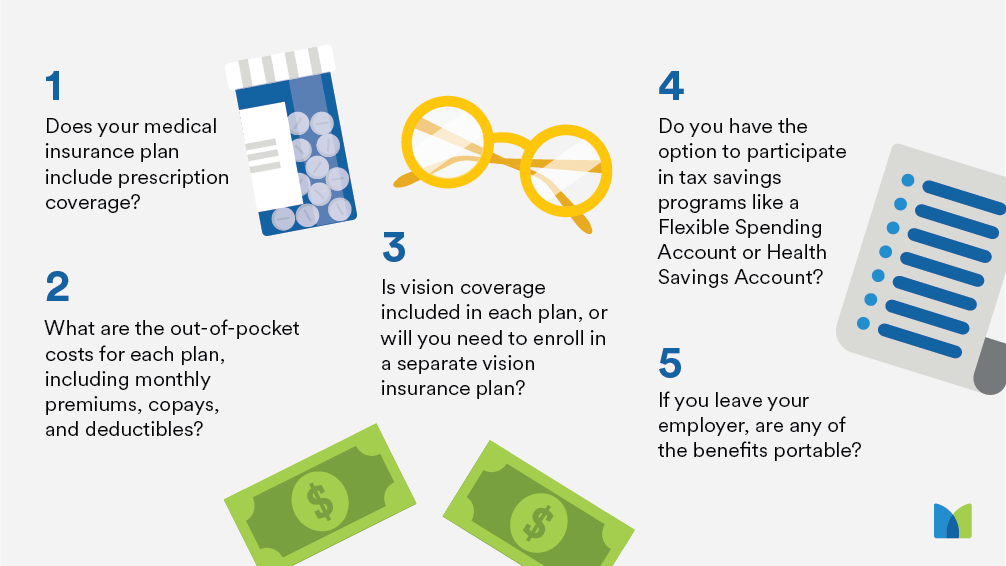

With a healthiness insurance coverage plan, you help shield the health and wellness and financial future of you and your family for a life time. Medicare Advantage Agent. With the new methods to get cost effective medical insurance, it makes good sense to obtain covered. Other crucial benefits of wellness insurance coverage are accessibility to a network of physicians and medical facilities, and various other resources to aid you stay healthy and balanced

Medicare Advantage Agent Can Be Fun For Anyone

Today, roughly 90 percent of united state residents have medical insurance with significant gains in health and wellness insurance coverage taking place over the past five years. Medical insurance helps with access to care and is connected with reduced fatality prices, much better health results, and enhanced efficiency. Regardless of current gains, even more than 28 million people still do not have insurance coverage, placing their physical, psychological, and economic health at risk.

In specific, current research studies that assessed adjustments in states that increased Medicaid compared to those that didn't underscore the worth of coverage. Grown-up Medicaid enrollees are 5 times more probable to have routine sources of care and four times most likely to obtain preventative treatment services than individuals without coverage.

Medicare Advantage Agent Fundamentals Explained

The high price of uninsured puts stress on the broader health and wellness treatment system. Protection Matters is the very first in a series of six reports that will be provided over the following 2 years recording the fact and effects of having actually an approximated 40 million individuals in the United States without wellness insurance policy protection. The Committee will look at whether, where, and exactly how the health and wellness and monetary concerns of having a large uninsured population are felt, taking a broad viewpoint and a multidisciplinary method to these concerns.

The Single Strategy To Use For Medicare Advantage Agent

Following the lengthiest economic expansion in American background, in 1999, an estimated one out of every 6 Americans32 million adults under the age of 65 and even more than site 10 million childrenremains uninsured(Mills, 2000 ). This structure will direct the evaluation in doing well reports in the collection and will be customized to attend to each report's collection of topics.

The very first action in identifying and gauging the effects of being without health insurance and of why not find out more high without insurance rates at the community degree is to acknowledge that the functions and constituencies offered by wellness insurance policy are multiple and distinctive. The supreme ends of health and wellness insurance protection for the specific and communities, consisting of workplace areas of staff members and companies, are enhanced wellness results and high quality of life. Practically half(43 percent )of those evaluated in 2000 thought that people without wellness insurance are a lot more most likely to have wellness problems than he said people with insurance policy.